The Property Institute (TPI) has been concerned about rising service charge bills for some time, and in response to concerns and questions from leaseholders and other stakeholders, we have collaborated with our members to release service charge cost data and investigate the drivers behind rising service charge bills.

We are pleased to introduce the TPI Service Charge Index and Report, which will be repeated annually, to provide averaged data on service charge expenditure across the estates our members manage, as well as a detailed analysis into the trends, and the factors causing rising bills.

Why are Service Charges Increasing?

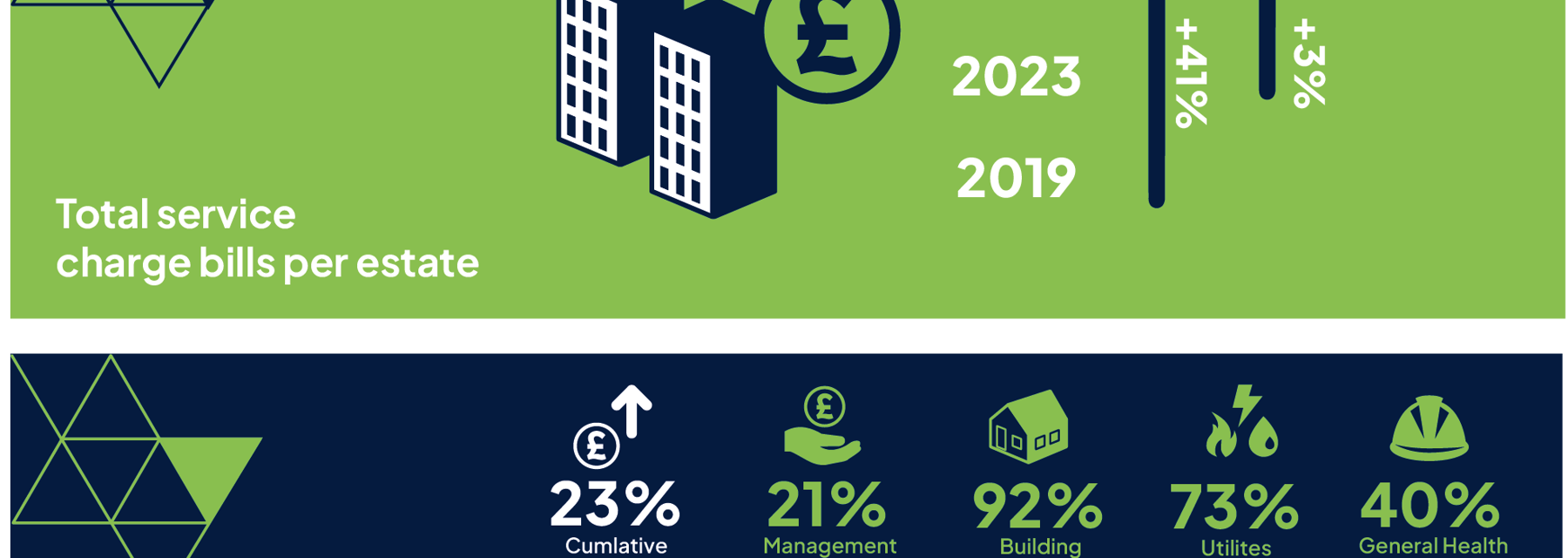

Over the last 24 months or so, leaseholders are likely to have seen their service charge bills go up significantly. In its newly launched Service Charge Index, The Property Institute (TPI) has reported average service charge increase of 41% since 2019, as compared with a cumulative inflation rate of 23% over the same period. In the last year, there has been a 3% increase in the average service charge bill, according to the data, based on data gathered from 108 estates. In 2024, the average service charge cost per estate was reported at £467,138, meaning an average of £3,634 per leaseholder.

While unwelcome, this should not come as a surprise. After all, people who live in freehold homes have had to contend with rising energy costs, higher building insurance premiums and increases in cost to home improvement or repairs and maintenance projects. These are all things that leaseholders pay for through the service charge and contributions to reserve funds. Rather than making a profit, managing agents collect service charge funds to meet real expenditure.

However, in addition to repairs and maintenance, insurance and energy, this year managing agents – and therefore leaseholders – are having to contend with the cost of implementing the new building safety regime, which was brought in by the Building Safety Act in 2022. Depending on the complexity and age – among other factors – of a building, the cost of implementation can vary hugely. Unlike cladding remediation, the government made no provision for this to be paid for by anyone other than leaseholders.

“The Property Institute and its members have been concerned about rising service charge bills and the long-term impact on reserve funds for some time. The cumulative impact of a pandemic, an energy price crisis, and the addition of the new regime requirements for building safety, and a cost-of-living crisis in the last couple of years has undoubtedly contributed to soaring costs for labour, materials, utilities, staff and insurance – as is evidenced by our Service Charge Index" said Andrew Bulmer, CEO of TPI.

“We are fully supportive of the new building safety regime; however, it cannot be denied that safety comes at a cost. A further complication is that not all the costs have been clear as early as we would like, while professionals have been waiting for details in secondary legislation, some laid only this year. As a result, I am not surprised that many leaseholders are as dismayed as we are by some substantial increases in their service charge bills, often at short notice."

In 2024, the average service charge cost was £3,634 per leaseholder.

What are Service Charges?

Service charge money paid by leaseholders is held in trust in ring-fenced designated bank accounts (under Section 42 of the Landlord and Tenant Act 1987). It is used to maintain the structure and common parts of a long leasehold building and covers the cost of the services provided – the lease will set out how service charges are to be accounted for and which costs are to be paid for by leaseholders.

Typically, the service charge will cover maintenance, cleaning, groundskeeping, repairs, health & safety compliance, inspections, surveys, energy supplies, buildings insurance, on-site staff costs and other general expenses, all incurred in the upkeep of the building.

All leaseholders paying variable service charges (based on apportionment) should receive an annual statement from their landlord or RMC – or their appointed managing agent - within six months of the end of the accounting year. The annual statement should include an income and expenditure account and a balance sheet. An independent accountant should examine all annual statements of account before they are issued to leaseholders. Any surplus or deficit is accounted to the leaseholders at year-end, not kept by the managing agent, RMC or landlord.

The main drivers behind Service Charge increases

-

As anyone who has visited a supermarket in the last two years knows, inflation in the UK has been running well above the Bank of England’s (BoE) target of 2%. In the autumn of 2022, it hit 11%. By February this year, inflation stood at 4% - substantially down but still double the BoE target. Without a period of deflation - which is widely seen as a worse problem than inflation by the vast majority of economists - those increased prices are here to stay.

Across the board, inflation adds costs to businesses as well as households. However, there are some services provided by property management firms that are particularly affected and that need to be met through service charges. Most obviously, managing agents are responsible for the repair and maintenance of blocks and are therefore vulnerable to construction cost inflation, which covers both materials and labour costs.

In May 2022, construction cost inflation hit a record high of 10.4%, according to the Office for National Statistics. In 2023, the figure was 4.1%. And according to cost consultancy Currie & Brown, construction cost inflation is likely to come in at between 3% and 3.8% this year. Nick Gray, chief operating officer, UK and Europe, at the company said: “Cost escalation is a significant challenge for the construction industry, but it is also nothing new. For the past 10 years we have seen construction costs rise on average by 4.6% per year.”

In its latest index, the Building Cost Information Service (BCIS) shows that labour costs have overtaken material costs as the key cost driver in 2024, with price growth peaking at 8% in the first quarter. Looking ahead over the next five years, the latest forecast data from the BCIS predicts an increase by 15% over the next five years.

The story when it comes to energy price inflation is more dramatic still, which again has an impact on service charges. According to the independent House of Commons Library, global prices for gas, electricity, oil and other fuels started to increase from summer 2021 when economies began opening up after pandemic-related lockdowns.

However, in a report published in February this year it added that this was just the start of the problems. “Prices increased further in late 2021/early 2022 and spiked after Russia launched a full-scale invasion of Ukraine on 24 February 2022. Energy prices in Europe remained very high for much of 2022 with continued concerns around disruption to supply, particularly from Russia. Wholesale prices for gas and electricity reached new record highs in the UK, Europe and elsewhere during this ‘energy crisis’ and have not returned to their earlier levels.”

The TPI Service Charge Index shows that utility bills, for the supply of energy to the common parts of a building, have increased by 73% in the last five years. Notably, the 2024 costs are lower than 2023, when the effects of the energy crisis was in full swing.

-

The costs of insuring residential blocks has increased dramatically, again for a variety of reasons. It may sound odd, but the UK’s exit from the European Union (EU) is a contributory factor. The reason is that all insurance companies need to source reinsurance treaties, which in effect insure the insurer.

“The vast majority, if not all, of those reinsurance companies are EU-based,” said Rob Mayo, CEO at insurance broker Insurety. “And of course, now that we are outside the EU, we are deemed to be a slightly higher risk for reinsurance than we were within the EU and as such reinsurers are applying a higher charge to provide UK insurers with that capacity.”

The reason is that when the UK was within the EU, UK insurers were subject to the same regulatory regime as their EU counterparts. Obviously, that is no longer the case and regulatory responsibility has passed to the Financial Conduct Authority (FCA) in London. “The FCA is very, very closely aligned, but I would suggest that reinsurance companies have probably seen an opportunity to charge more and have done so,” says Mayo.

Insurance companies are also having to price in higher materials costs now that we are outside of the EU. Quite simply, if something does go wrong and a block has to be fixed or even rebuilt, the materials used will be more expensive as a result of Brexit. “A huge percentage of British building materials were sourced from mainland Europe and obviously while we were within the EU, they were tariff free,” says Mayo. “Obviously, now those tariffs are applied.”

The biggest factor involved in rising premiums, however, was the Grenfell Tower tragedy. Before the fire, insurers didn’t consider residential blocks to be particularly risky assets to insure. “It was always thought that buildings were built with bricks, stone, tile, concrete and so on,” says Mayo. “They never dreamed of flammable cladding being included within these buildings and it shocked a huge number of insurers into thinking ‘what are we actually insuring?’. A number of insurers almost overnight decided to come out of the residential market.”

Those that remain in the market are still incredibly nervous about insuring large blocks especially, as Mayo can attest. “As a broker, I’ve got access to probably about 600 insurance companies globally,” he says. “But as soon as I mention the word ‘cladding’ or ‘flammable insulation’, on a really good day that would probably go down to about three or four.”

So, the supply and demand situation when it comes to insurance was severely impacted, which inevitably pushed up costs for those seeking cover. And that was before the Covid-19 pandemic. Unlike most sectors of the economy, construction was never actually locked down in the UK and developers soon realised that they could work far more quickly when they had the roads to themselves.

“The number of blocks that were being built sped up massively,” says Mayo. “Buildings were being put up at unprecedented rates. I think the main reason for that was that most blocks of flats are in city centre locations and instead of a brick lorry sitting in London traffic for two hours to get through to site, they were sailing through in 20 minutes because there was no traffic. The need for insurance increased, but the number of insurers willing to take it on had decreased. There was another massive squeeze on supply and demand.”

The resulting increase in premiums has been eye-watering. “I've got a quote for a building on my desk right now that historically had been paying £3,000 a year and now they're quoting £35,000. And that is not unusual."

Buildings that are high-rise or high-risk, such as those with dangerous cladding or other safety defects have seen the biggest premium hikes. In 2021, TPI collected insurance data from 13,570 homes and found that on average, flat owners saw their premiums rise by 400% – or nearly £1,100 each – from 2019/20 to 2020/21.

According to data supplied to TPI, building insurance costs have increased 92% in the last five years. The impact of the building safety crisis on insurance premiums has been disproportionately felt in taller buildings – the Index shows a 92% increase in premiums over the last five years in estates with 18m+ buildings, whereas for those below 18m, insurance costs increased 68% across the same period.

Of all expenditure items, insurance is the biggest driver for service charge increases.

-

And then, of course, there are the costs involved with the government’s response to Grenfell. Most obviously, buildings up and down the country are still being remediated, largely to remove unsafe cladding but hardly exclusively so as other external and internal defects have been uncovered. Ultimately, the Building Safety Act introduced leaseholder protections for some leaseholders, but there are exclusions to these protections, including buildings where the residents own the freehold, or where a leaseholder owns multiple properties.

However, the government’s pledge does not cover the costs of implementing the new building safety regulatory regime, overseen by the Health and Safety Executive’s Building Safety Regulator (BSR), to prevent a repeat of the Grenfell tragedy. On that point, government communications have not been as clear as they could have been, leading to confusion among leaseholders and industry alike.

“What seems to be the source of the confusion is that leaseholders say ‘well, [housing secretary] Michael Gove told me that I would be protected from all of these costs’,” says Cassandra Zanelli, solicitor and founder of Property Management Legal Services (PMLS).

“They don't distinguish between the two tranches of costs. They think they are protected under the Building Safety Act (BSA). But while some leaseholders are protected from the remediation costs, they aren’t protected from all the new regime costs as well – including the new requirements under the BSR for registration and application of the Building Assessment Certificate. Making that distinction really, really clear would have been incredibly helpful.”

A director at a leading managing agent agrees. “I think one of the reasons why some of the reactions to service charge increases from leaseholders are as strong as they are, is because Michael Gove announced that leaseholders won't have to pay for safety,” they said.

“I think it's created this whole raft of confusion amongst leaseholders, so that now they’re receiving bills they’re going ‘hang on a minute, the government said I wouldn't have to pay for this. Why am I having to pay? ‘Ultimately, it’s leaseholders who are suffering.”

Clearly, the costs of remediating a building far exceed those of complying with the new building safety regime, but that doesn’t mean that they are insignificant. What’s more, the original developer or current freeholder is under no compulsion to pay and in any case may be next to impossible to track down. In most instances, the responsibility for complying with the regime rests with the Principal Accountable Person for the buildings, which then needs to recoup the costs in the form of the service charge.

In its impact assessment, the government anticipated that the cost of preparing a safety case (just one of around 20 new requirements and actions for all 18m+ buildings) under the BSA would come in at around the £3,500 mark. It’s an estimate that doesn’t withstand contact with reality. In fact, The Property Institute called out the original impact assessment and urged a review and re-issue. The absolute minimum, according to one agent, is about £6,000, but the vast majority of buildings will require significantly more. For large, complex buildings, the cost of compliance has been known to top £100,000.

Part of the problem is that there are so many variables. Are the required plans in place? If not, they will need to be produced afresh, which involves hiring a specialist surveyor.

Is what looks like a single block actually made up of multiple cores? If so, a separate safety case will have to be produced for each constituent part of what is ostensibly a single building. Are all the necessary documents readily available? Almost certainly not - a complicated building might need up to 500, all of which need to be produced and signed off professionally.

The list goes on. Nobody doubts the importance of having a robust building safety regime - that there could be another Grenfell is unthinkable. But putting that regime in place comes at a cost and ultimately somebody has to pay if the government is unwilling to do so.

Philip White, Director of Building Safety, at the Health & Safety Executive’s (HSE) Building Safety Regulator, added: “The Building Safety Regulator was established to enforce important building safety regulations in England. Navigating this new building safety regime effectively requires

collaboration among various stakeholders in upholding and complying with mandatory safety standards.“The government has pledged support to leaseholders by differentiating between remediation and new safety regime costs. Safety case reports, now required for residential buildings over 18 meters tall, play a vital role in identifying and managing safety risks to ensure resident safety. We understand concerns about inflated charges for related services. The focus should be on ensuring that the arrangements to manage the safety of residents and visitors are effective, appropriate, and proportionate. It’s important for service charges to be communicated transparently and reasonably to leaseholders.”

As highlighted by the TPI Service Charge Index, of the 50 estates in scope of the new BSR regime, 38 have incurred BSA-related costs passed through service charge bills in 2024 – whilst the average is reported at over £28,000 (around £177 per leaseholder), ten estates incurred costs of over £50,000. Many more estates will be seeing building safety-related costs in their 2025 service charge bills, as the BSR starts calling buildings forward for inspection from April

The Service Charge Index will be updated annually with new data. If you have any enquiries or questions about the Index and Report, please contact Jaclyn Thorburn jthorburn@tpi.org.uk